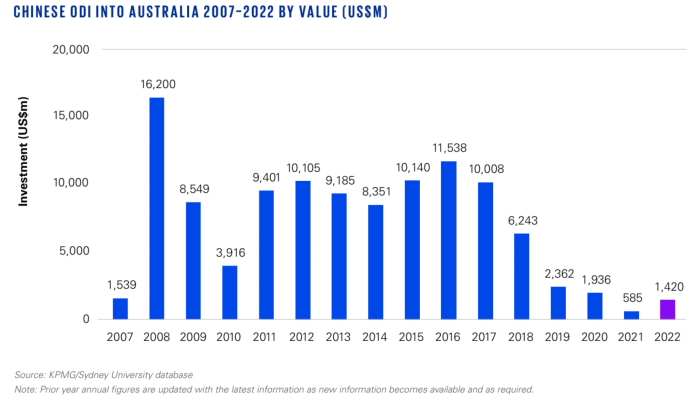

Last week I attended the launch of the annual survey conducted by KPMG and USYD on ‘Demystifying Chinese investment in Australia 2023’ which includes 2022 and now shows the full picture going back to when the survey started in 2007 (16 years in total – see chart below).

At first glance, the picture looks somewhat dismal and reflects a worldwide trend which has seen a dramatic reduction in outbound Chinese investment, especially into western countries, since 2017 (the year when US President Trump started imposing executive actions against China).

However, what’s missing from recent numbers are the larger number of smaller transactions which represent Chinese investment into foreign innovation and technology (e.g. in priority areas like health, fintech, AI, renewable energy, agtech etc.) which, whilst not appearing on the public record, are significant in their own way and will play a much more important role in future. When you take out the top 100 largest corporations in Australia, what’s left are predominantly the SMEs (small to medium sized enterprises, with fewer than 20 employees) of which there are around 2.6 million businesses (97% of the total) and it’s in this area that we will see more activity in the future.

As China invests trillions into its advanced manufacturing sector, acquiring and partnering with foreign entrepreneurs to kickstart its own economy, move up the value chain and dominate global markets, it will be the smaller deals in foreign SMEs, including those in Australia, which will become more relevant. Not many of these will be noticed or recorded in future surveys.